Used by employees from leading world companies as well as niche players

Best value offer for PE/VC data

Seamless lightweight UI/UX alternative to generalist and expensive solutions

Chat-based AI*

|

Large corporate databases* with analytics

|

PRIVATE EQUITY LIST

|

|

|---|---|---|---|

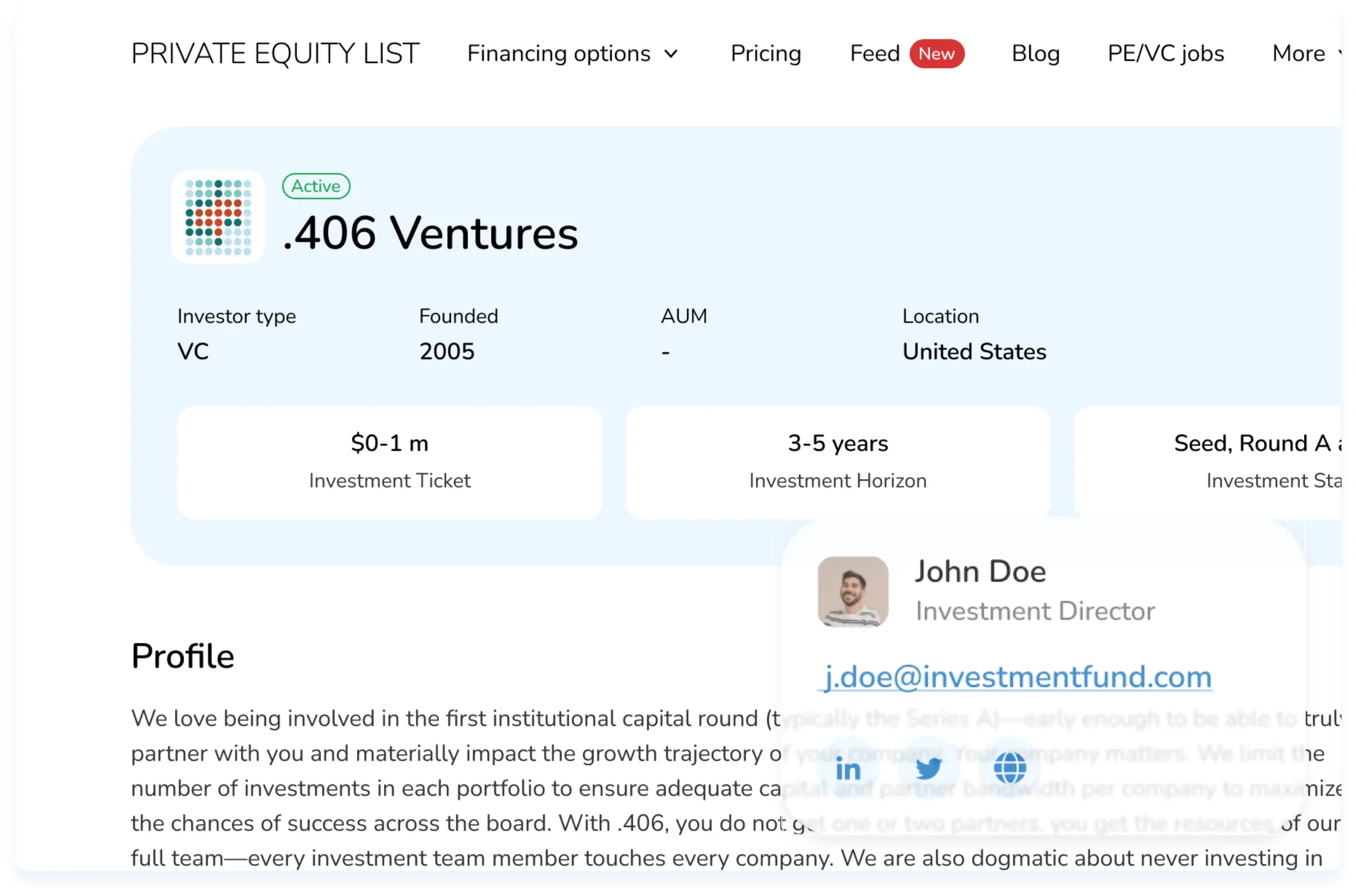

| Targeted PE/VC investor lists | Summarized results from generalist models not tailored for PE/VC search | Powerful filters but usually locked completely behind a paywall | PE/VC-first filters (geo, stage, thesis) Available without demo |

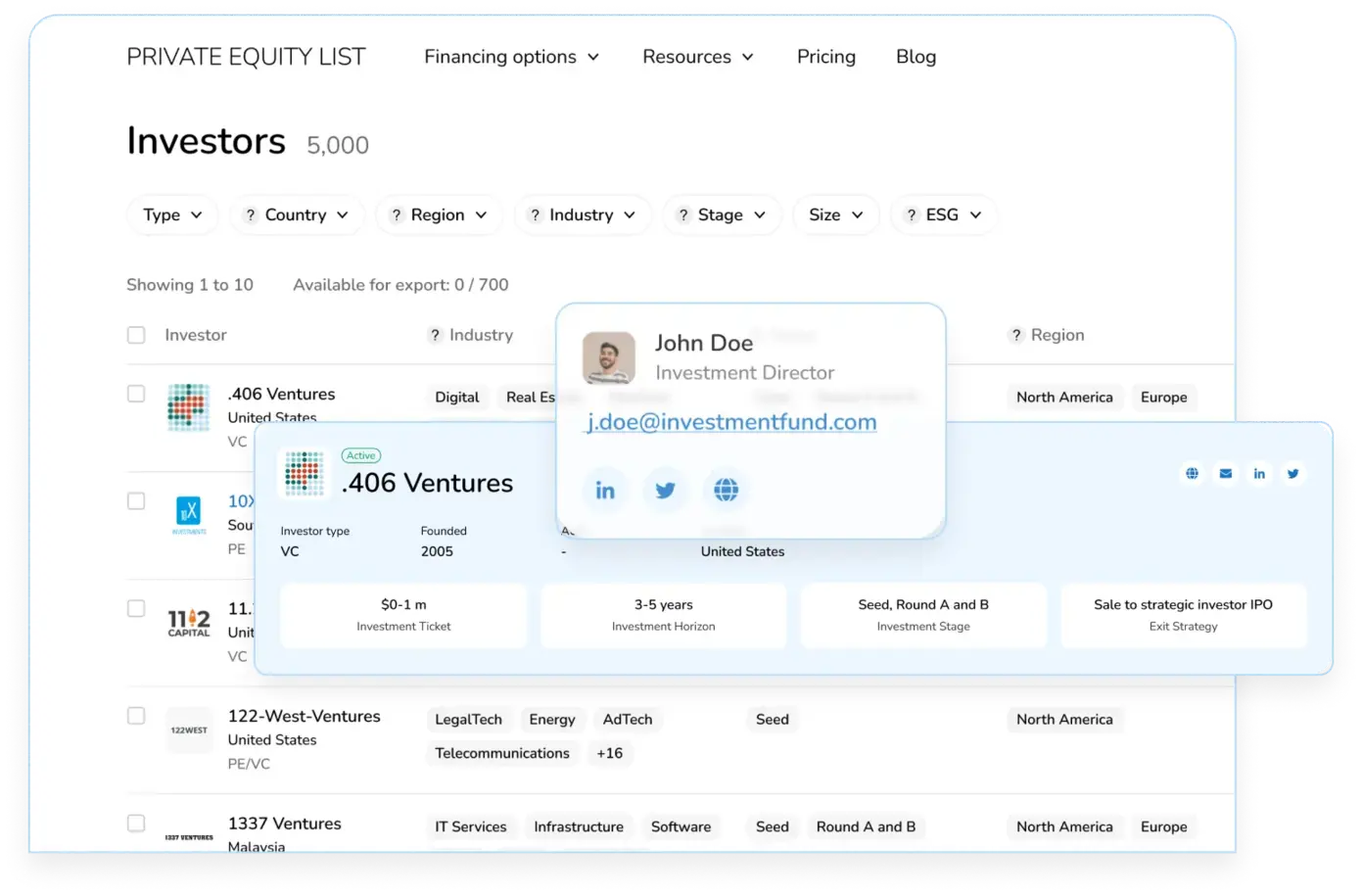

| Investment team contacts and information | No contact extraction (in bulk .csv) | Available, but can be very expensive | Roles + contact enrichment Export-ready at a much affordable price |

| PE/VC investors data | Source-mixed, may hallucinate Not export friendly |

Massive data amounts, but with analytics overload (= higher pricing) | Updated nearly daily Human-curated data |

| Time to first usable PE/VC list | Minutes, but unstructured and unverified | Demo / learning curve may be needed | A few minutes to get structured filtered PE/VC lists |

| Pricing | Affordable, but with limitations for practical use | Can be very expensive (unclear pricing) | Best value offer |

| Best for | Quick research & brainstorming, but not advisable for fundraising | Enterprise level companies, large PE/VC funds, who are ready to pay a lot | Both small and large teams (founders, consultants, VC ecosystem and everyone else) |

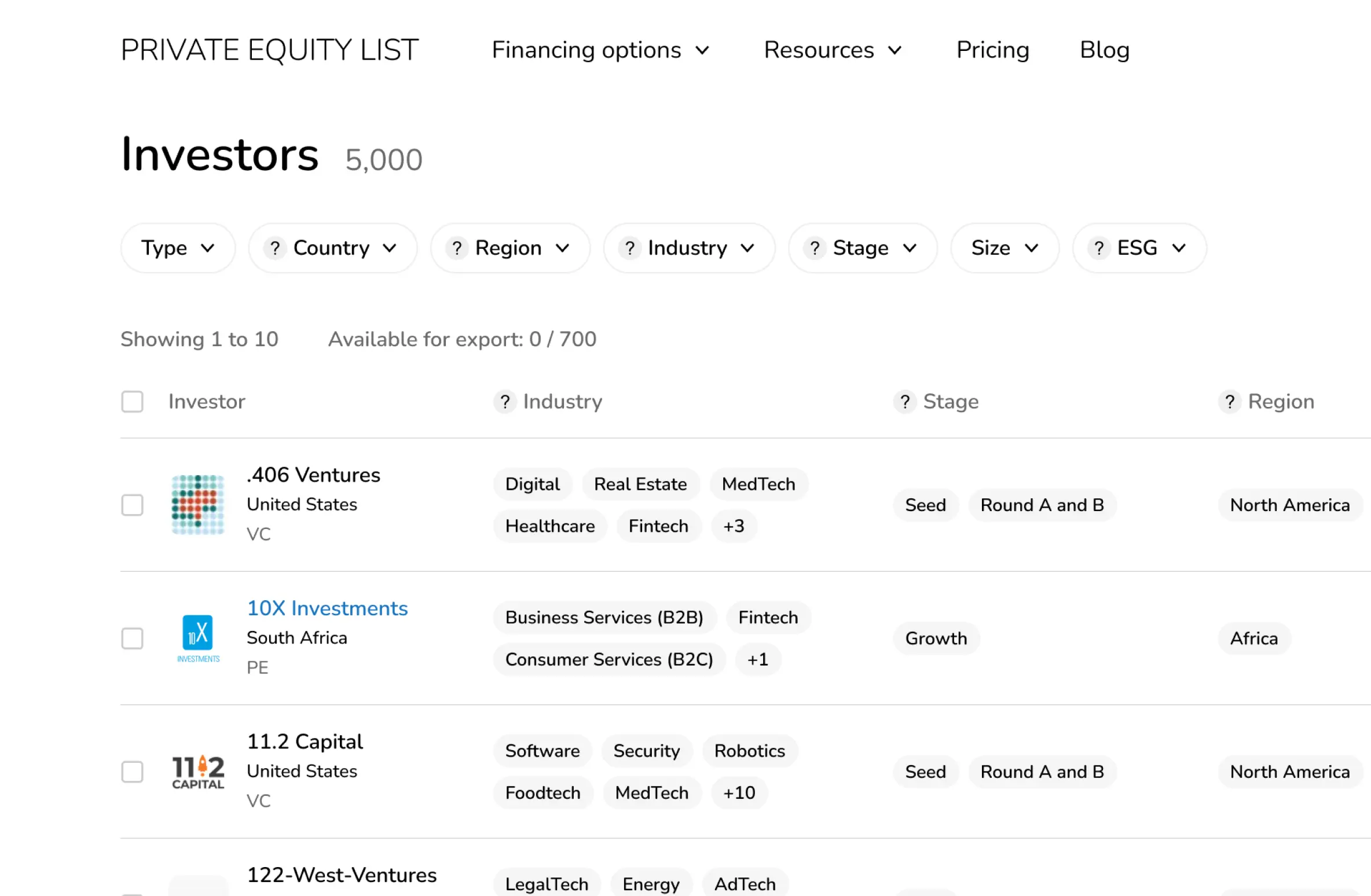

Super Intuitive Investor Search

Quickly find investors for any project

Super Intuitive Investor Search

Quickly find investors for any project

6,257 +1

PE/VC investors globally

23,923 +0

Contacts of investment teams

Worldwide PE/VC coverage

US, EU, MENA, SEA, LATAM and more

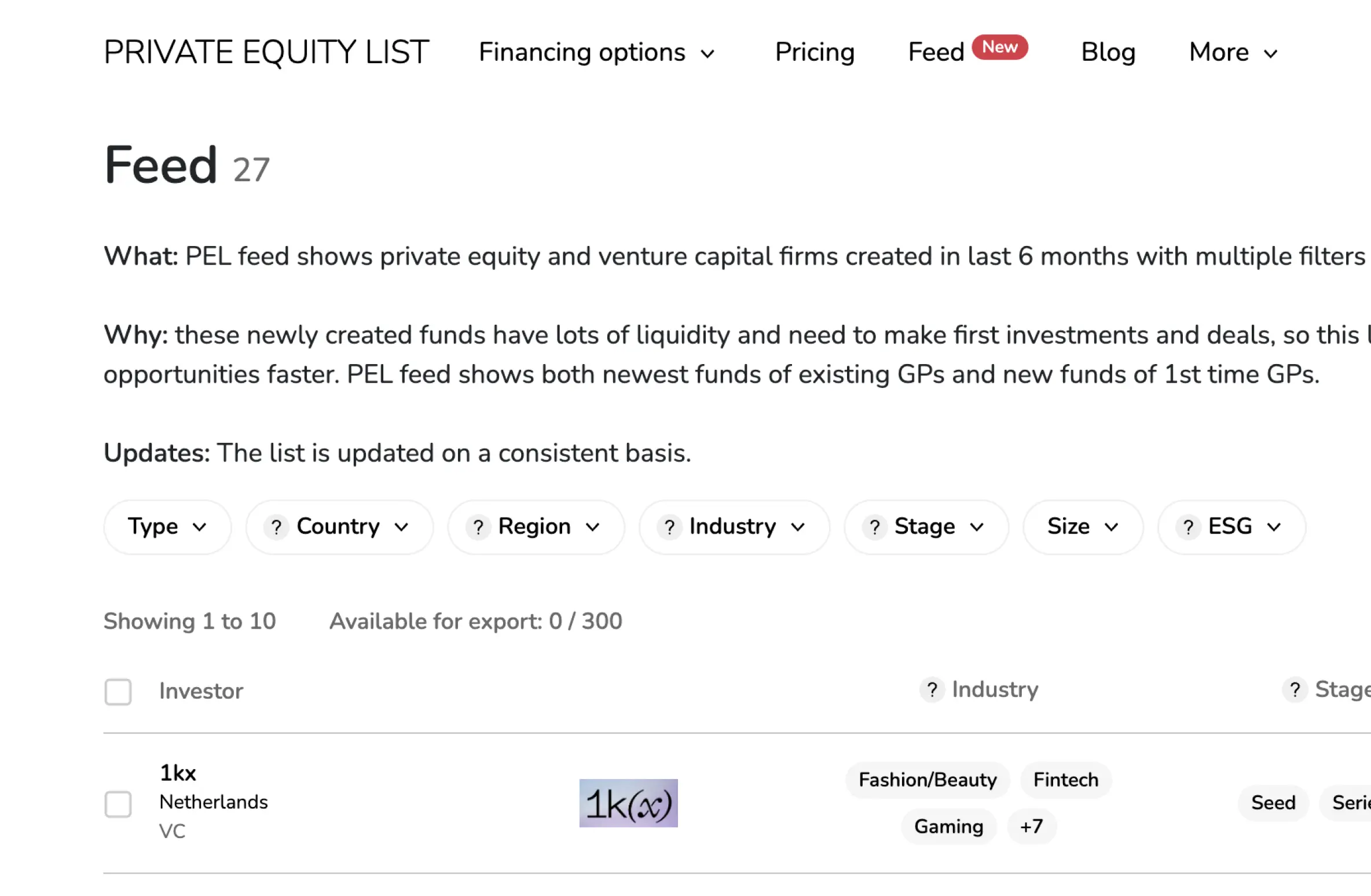

New VC funds focus

For early stage founders

Solutions for wide range of clients

We are used by both large corporates as well as smaller teams or even solo founders

What our users say

How Private Equity List helps professionals around the world

Premade lists

Already prepared investors list for hot industries

Edtech

1,635 PE/VC funds

Gaming

896 PE/VC funds

E-commerce

668 PE/VC funds

Cannabis

99 PE/VC funds

Robotics

886 PE/VC funds

SaaS

839 PE/VC funds

Fintech

3,722 PE/VC funds

Blockchain

540 PE/VC funds

AI

574 PE/VC funds

Impact investor

189 PE/VC funds

People of color

72 PE/VC funds

Women

129 PE/VC funds

FAQ

If our FAQ has no answers to your inquiries,

just play with the website

around some more. It is very simple

2. We have database of PE/VC funds that support women, LGBTQ and other minorities.

3. We focus on non-popular geographical regions such as MENA, APAC and even exotic regions where investor information is scattered and scarce (unlike in US/EU). Have you ever tried to find list investors of that operate in Bangladesh or Philippines? That’s not an easy task.

■ Startup founder searching for investors and seed financing

■ Investment research professional

■ Corporate finance consultant who is compiling a list of investors for your client

and anyone else who wants structured investor information.

1. Time. Just filter the investment criteria and get your investor contact list and save weeks of search.

2. Money. No need to pay money for uncertain results.

Focus on your startup!

Unlock the Best Funding Opportunities

We already have over 6,400 users who trust our platform to explore

ventures, accelerators and funding options at every stage.